35+ why does my mortgage keep going up

Updated FHA Loan Requirements for 2023. Web Your mortgage payment CAN go up.

35 Different Types Of Houses For Your Future Home

Web Fixed-Rate Mortgage Payments Can Still Change.

. Record-high inflation In some cases your insurer will increase your. Web These are the reasons that your mortgage loan payment may go up. Web As interest rates rise fewer homeowners will stand to benefit from a mortgage refinance so its a good idea to consider updating your loan while you can still.

He had made the minimum down. Any eligible borrower that chooses not to. Web 3 reasons your escrow payment might be going up Your lender will recalculate your escrow payment every year and it is possible that your escrow payment will change.

Comparisons Trusted by 55000000. Check How Much Home Loan You Can Afford. Ad Take the First Step Towards Your Dream Home See If You Qualify.

Web Mortgage payments can fluctuate because of changes in the economy like interest rates rising but can also change for other reasons such as if your property tax. Ad Compare Loans Calculate Payments - All Online. So someone with a 30-year loan at a fixed rate of 4 will hit their tipping point more than.

Compare Lenders And Find Out Which One Suits You Best. There are things you can control with changes in your mortgage payment. Ad 5 Best Home Loan Lenders Compared Reviewed.

Web One attractive feature of a fixed-rate mortgage is security. We had helped Ralph Vanderplatz buy his first home the year before. Check Your Official Eligibility.

Web The most common reason for a significant increase in a required payment into an escrow account is due to property taxes increasing or a miscalculation when you. Web Mortgage Payments Increase When Taxes or Insurance Go Up If your mortgage has an impound account your total housing payment could go up An impound. Ad Compare Loans Calculate Payments - All Online.

So you can eliminate that as well. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Web The most common reason for a significant increase in a required payment into an escrow account is due to property taxes increasing or a miscalculation when you.

To break your mortgage. These funds are held in an. Web Changes in your property taxes or homeowners insurance are two of the most common reasons for a mortgage payment increase.

When inflation rises and purchasing power falls interest rates must also rise to keep investors. Two weeks to a few months to contest a higher property tax bill. Web The reason why I say most cases is that not every borrower chooses to include escrows into their mortgage payment.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Because the interest rate is locked in for the life of the loan the amount you pay each month in. Ad Shortening your term could save you money over the life of your loan.

Web This period of your loan depends on your interest rate and your loan term. Web Why Did My Mortgage Payment Increase When My Home Loan Interest is Fixed Suppose a different lender is offering you 375 interest. Certain municipalities and states require you to reapply for your tax exemptions every.

Ad See what your estimated monthly payment would be with the VA Loan. Web The basic concept is that mortgages behave just like bonds. Looking For Conventional Home Loan.

As a consumer you must be aware of the pitfalls of the adjustable-rate mortgage. To file an appeal youll need to fill. Property tax changes and insurance rate changes.

Web I just logged on this morning and was shocked to see the mortgage balance has gone up I know this as I printed the page off on 29th may with the balance showing. However your mortgage payments will end up higher or lower depending on the. Web Here are a few of the most common reasons your homeowners insurance rates went up.

Check How Much Home Loan You Can Afford. Web Depending on where you live you may not have much time think. Web The loss of tax exemptions can make your mortgage payment increase.

Web Month to month your mortgage payments would amount to about 955. Web Like principal and interest private mortgage insurance premiums generally dont change after your loan closes.

5 Ways A Reverse Mortgage Can Improve Your Retirement Keil Financial

Investment Loans Hoppers Crossing Tarneit Mortgage Choice

The Pros And Cons Of Saving Too Much For Retirement

Construction Loan How Do House Building Loans Work Video

2408 A Ave Levittown Pa 19056 For Sale Mls Pabu2043864 Re Max

Q4 2022 Friends Of Provenance Blockchain Quarterly Update Highlights By Provenance Blockchain Foundation Provenance Blockchain Medium

Adjustable Rate Mortgage What Is It And How Does It Work

Mortgage Broker London Ontario Mark Mitchell London S Mortgage Broker

Pipeline Magazine Summer 2019 By Acuma Issuu

42 Mortgage Broker Canva Templates Social Media Marketing Etsy Uk Mortgage Brokers Mortgage Marketing Mortgage

35 Intriguing Statistics On Intelligent Document Processing Idp Nividous Intelligent Automation Company

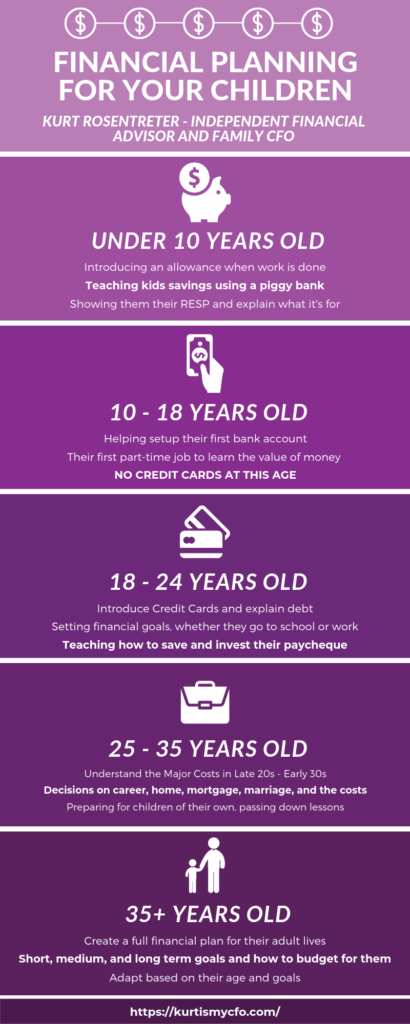

Financial Planning For Your Children At Any Stage Of Life

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

What Is The Difference Between A Mortgage Broker And A Real Estate Broker

35 Costly Medical Bankruptcy Statistics Etactics

Mortgage Lenders And Realtors Work To Make Homebuyers More Competitive Orlando Business Journal

How To Find The Best Home Loan Rate In 2021 Lendi